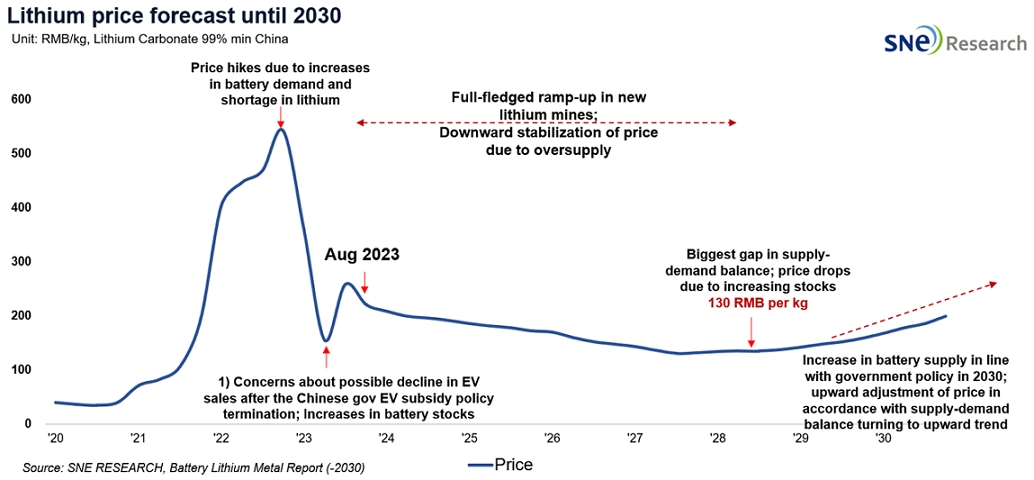

Expected Lithium Supply in 2030 to Reach 3.33 mil ton:

Lithium oversupply possibly leading to downward stabilization of lithium carbonate price

- In 2028, the price of lithium carbonate may plummet to 130k yuan per ton

The price of lithium, which has recently seen a big drop, is expected to experience downward stabilization in the long term. It seems to tick up after years of gradual declines till 2028.

According

to

The price

of lithium carbonate is forecasted to remain at a downward but stabilized trend

till 2028. A major reason for such downward momentum is possible increases in

supply as those new lithium mine projects are expected to start operation in

full swing. The consequent oversupply may cause an imbalance between supply and

demand. After breaking a record for the gap between supply and demand in 2027,

it is expected to lead to a drop in the lithium price in 2028 down to 130k yuan

(approx. 28 million won) per ton.

A

decline in the price of lithium may act as a burden for mining and refining/smelting

companies. Under these circumstances, those global mining companies who have relatively

higher margins than others are expected to survive from the competition.

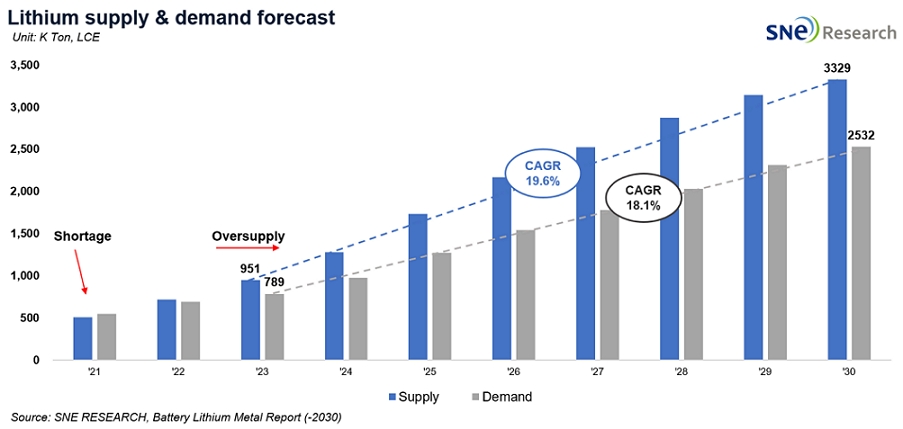

On the other hand, the production of lithium by global mining companies are expected to increase from 0.95 million ton in 2023 to 3.33 million ton in 2030, at a growth rate of nearly 19.6%. Likewise, demand for lithium is forecasted to increase from 0.79 million ton per year in 2023 to 2.53 million ton per year in 2030, posting a high CAGR of 18.1%. However, as the rate of demand growth seems to be relatively lower than that of lithium supply, approx. 0.79 million ton of oversupply is expected in 2030.

Along

with the exiting lithium mining countries such as South America and Australia, minor

players are expected to join the game, including North America, Europe, and

Africa. The advent of new mining countries may bring about a positive impact on

the lithium industry; for instance, diversification of supply chain and securement

of price stability.

The Inflation Reduction Act announced by the US stipulates that at least 40% of the critical minerals in the battery should come from the United States or a Free Trade Agreement (FTA) partner. This opens up an opportunity for other countries to join the lithium mining business in order to respond to the IRA. All of these are expected to lead to increasing opportunities for battery makers to be supplied with lithium which abides by the IRA regulations.